A curious headline for the article, so let’s put it another way: if I give money to The Rotary Foundation (TRF), what will it be used for, and how will I and others benefit from it?

First of all, let’s explore a myth about giving. A few months ago, a district leader told me that individuals were not allowed to make financial contributions to the Foundation. They were adamant that donations could only be given by clubs.

Listen to this article

Worryingly, this is not the first time I have heard this view expressed.

Whilst many Rotarians do contribute via their clubs, it is certainly not the case that individuals cannot contribute directly. In fact, the contrary is true.

Our legacy to the Foundation will provide a lasting income stream to support the immeasurably valuable work of future generations of Rotarians.”

Individuals are encouraged to make financial contributions directly to TRF – ideally via The Rotary Foundation UK to get gift aid, where applicable, with credit given to the member’s club as well.

However, currently, less than 15% of Rotarians in Great Britain and Ireland donate money directly to TRF which can be identified as a personal contribution.

So why do people give money to TRF? Over the past couple of years, as Endowment Major Gift Advisors covering Great Britain and Ireland we have had confidential discussions with many Rotarians, and some non-Rotarians, about what motivates giving to TRF.

Rotarian helping a young boy with his education

Although the awarding of a pin, plus a mention at a district or national event is, for some, a nice way of being recognised, because it also gives them an opportunity to encourage others to give, this is not for everyone.

The overwhelming response is that it’s not for the recognition, but to give others who are less fortunate an opportunity that can be leveraged by the support of our own charity.

What other charity gives you the opportunity to state what the money will be spent on? With the seven areas of focus, it is highly unlikely you couldn’t find a cause which you aren’t passionate about.

Over the past four years, TRF has given in excess of 500 grants with contributions from the World Fund of around $10 million.

Even when the world was so severely restricted by the impact of COVID-19, these grants continued, in addition to delivering around $870,000 in district grants.

Put another way, more than $10 million worth of projects have benefitted from a financial contribution from the Foundation.

People of Action planning architectural work.

In Great Britain and Ireland, the total amount donated to the annual fund in the last Rotary year was $2.38 million. That means in three years’ time that this money will come back as District Designated Funds – or Rotary funds managed by the district – worth around $1.2 million.

It is clear that if donations amount to less than the outgoings, then the funding model is unsustainable which won’t be able to financially support projects in the way which we have traditionally been used to.

What other charity gives you the opportunity to state what the money will be spent on? With the seven areas of focus, it is highly unlikely you couldn’t find a cause which you aren’t passionate about.”

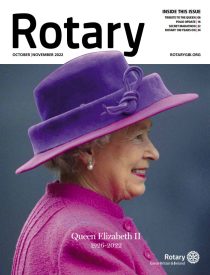

Last October, Rotary magazine published an article when a number of current donors told us why they gave financial support to The Rotary Foundation. This obviously struck a chord with readers since this resulted in donations or pledges to TRF in excess of $5 million.

District Governor Nick Gidney and his wife Sue from District 1180, which covers North and Mid-Wales, Merseyside, The Wirral and parts of Cheshire, Shropshire and Lancashire, saw the article. The feature prompted them to do something positive for TRF, but why did they do it?

Nick explained: “As Rotarians, we have a moral duty to lead by example and use what we have built up in our estates to be of help to others. That sentiment is deep-rooted in our Rotary values and service above self-principles.

Rotarian helping school children.

“Our legacy to the Foundation will provide a lasting income stream to support the immeasurably valuable work of future generations of Rotarians.

“The knowledge that we’re helping others is both empowering and fulfilling.”

Nick and Sue were given the opportunity to direct their legacy to one of Rotary’s seven areas of focus. However, their response was: “When the legacy is realised we don’t know where the greatest need will be, so we would like the trustees of TRF to decide where the money can be best used.”

So reverting back to the original question ‘What’s in it for me?’ – everyone’s reasons for giving are motivated by different things. But, by giving to TRF, you know that your donations and legacies are being used to continue the work which you, as a Rotarian, so clearly value.

If you want to know more about how you can make a personal donation or leave a legacy to The Rotary Foundation, speak in confidence to the Endowment and Major Gifts Advisors: Mike Hodge at: michael.hodge@ntlworld.com or Ian Priestley at: pdgianpriestley@gmail.com

FACTFILE: Make use of Gift Aid

GIFT AID – a way to make your personal donation stretch that little bit further – at no extra cost.

How? The answer to that lies in the unique tax incentive offered by the UK Government called “Gift Aid “which can add 25p for every £1 donation.

As a UK tax-payer, all you need to do is complete a declaration in support of the charity and the charity will do the rest.

Rotary Foundation of the United Kingdom (RFUK)’s Gift Aid Declaration Form is available online.

Over the last three financial years a total of £307,020 gift aid has been received from Her Majesty’s Revenue & Customs, however, if all the individual contributions qualified for gift aid the amount receivable from HMRC would have been £400,122 – that is an extra £92,102.

If you are wondering why RFUK is not receiving that extra refund, there are a number of reasons:

- Some individuals are unable to participate in the scheme (i.e. non-UK taxpayers, those paying insufficient tax, etc.)

- Clubs ask their members to support their own charitable trust and claim gift aid directly. In these cases, the trusts should ensure they remit the donation and relevant gift aid amount to RFUK

- Some individuals have never heard of the scheme and thus have not completed a declaration

We recommend you take a look at your personal giving record through My Rotary.

If you know you are donating but can’t see those donations, then it is likely that you have asked RFUK to credit your club with your contributions. This can easily be changed by contacting: