Rotarians are known as people of action, an example set by three members from three different clubs in West London and Surrey who are involved with a credit union.

Credit unions are community savings and loan co-operatives

Credit unions have come a long way from the man and his ledger in the church hall collecting savings and offering loans. There are around 500 credit unions in the UK, and more than 1.8 million members nationally.

A credit union works by pooling the resources of all members’ savings and prudently allowing members to take a loan from this pool of money. As this loan is repaid back into the mutual pool, it enables the credit union to operate and lend to more members.

Listen to this article

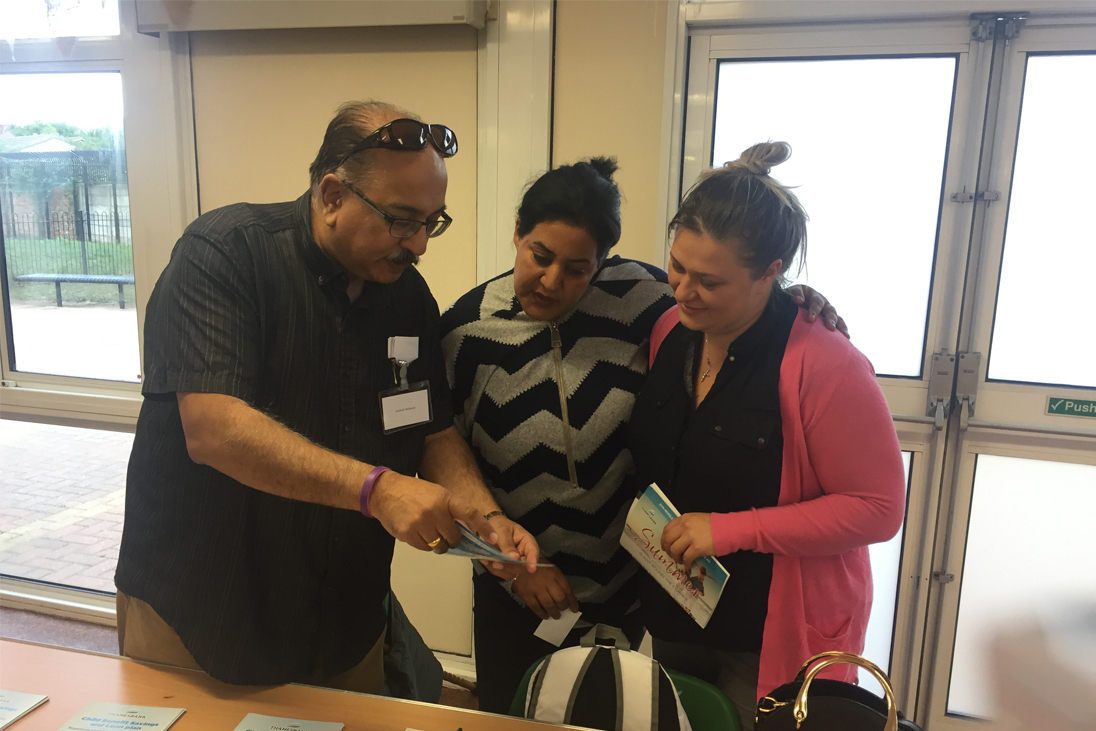

Mukesh Malhotra is Past President of Hounslow Rotary and the current Chair who oversees the running of the Thamesbank Credit Union.

Sarah Gardner, who is the current President of Elthorne-Hillingdon Rotary is Vice Chair, and Ekaterina Moteva, President of Egham Rotary, serves as Business Development Manager.

As a community co-operative, Thamesbank Credit Union is owned by its members and is a not-for-profit organisation. It offers ethical and affordable financial services, preventing poverty by providing members with a sustainable, affordable alternative to high-cost lenders.

Mukesh Malhotra explained: “It is not always about the people who don’t fit a typical bank loan.

Mukesh Malhotra oversees the running of the Thamesbank Credit Union

“Yes, we serve those who might have run into few difficulties and are barely scraping by at the end of the month. We have many people, who run into difficulties because suddenly their laptop breaks or their children suddenly need new uniforms which they have outgrown.

“Whatever the loan is for, we encourage putting a few pounds aside while repaying the money, so hopefully it becomes more of a habit, than a duty.”

A typical credit union could be described as a variation of a community bank. Like a traditional bank, savings are guaranteed by the Financial Conduct Authority, and all substantial loans are subject to relevant checks.

The difference is that the members are local, loans go to local people, the office is local and you know that at the end of the day the profits made don’t go for an expensive office building or the CEO’s expensive lifestyle.

Profits are shared amongst the members, and voted for at the annual general meeting, so every member has a say.

Thamesbank Credit Union is owned by its members and is a not-for-profit organisation

Sabrina Nandkishore is testimony of how Thamesbank can be a lifeline to anyone. She was a single mother bringing up two children who struggled dealing with finances.

She explained: “I slowly got into debt due to living expenses and childcare. I felt too embarrassed to discuss this with my family.

“After watching a money programme on TV discussing affordable borrowing, I found out about credit unions being more affordable than my credit cards.

“After setting up my account, I applied for a child benefit loan, and each month I have been very pleasantly surprised that I started to save.

“Thamesbank Credit Union would always pay some of my loan and deposit the rest of my child benefit into a savings account.

“Until then, I never had an opportunity to save any money. I began to pay off my loans and have some money for emergencies.

“I have been extremely lucky in the pandemic to still have a job, and have saved money by not commuting each day into central London.”

When you open a savings account, you become a member who makes regular payments into a savings account directly – from a salary if your employer can make payroll deductions, or by standing order.

These savings accumulate over time, allowing members to budget for future expenses or apply for low-cost loans based on multiples of the amount of savings they hold.

I slowly got into debt due to living expenses and childcare. I felt too embarrassed to discuss this with my family.”

Sarah Gardner, herself a mother with two young children, said that credit unions can serve pretty much everyone in the community.

“The stories that we hear from our members make us feel good about the everyday running of the business and thinking of its future.

“It is very fulfilling to be there, when people need you most and to know that we can extend a helping hand in time of need.”

There are numerous credit unions around the UK. Thamesbank operates within the London Boroughs of Ealing, Wandsworth, Hounslow, Richmond upon Thames, Kingston upon Thames and the Surrey Borough of Spelthorne.

Ekaterina Moteva said that many people have found themselves caught in spiralling debt, particularly during the pandemic. What Thamesbank is able to do is to operate at competitive rates to consolidate debt. They don’t charge early repayment or arrangement fees.

“Very often we hear that people become an easy target for loan sharks, because they are too embarrassed to speak about money worries,” she explained. “We would love to be there to help.”

Website: www.thamesbank.org